Advantages of Intellectual Property in M&A

- Value Creation and Addition: IP can help maintain and build the value of the asset portfolio held by the company, which finally adds to the reputation of the entity. Consider, for example, Johnson and Johnson, whose value of IP assets totals up to 87.9%; others like Microsoft and Merck are evaluated at 98.7% and 93.5%, respectively when it comes to their intangible assets. Since innovating through one’s R&D section may not always be a feasible option, considering IP as a subject-matter inclusive of the M&A transaction can be a better option. Therefore, companies should be on a constant lookout to identify novel and commercially viable innovations to add to their individual company portfolio.

- Transfer of Technology: IP, both as a consideration and subject-matter of the M&A, aids in acquiring the IP assets at much greater ease. The transfer of technology is simplified when compared to tangible assets.

- Diversification: While pursuing an M&A, diversification of business goals can be achieved through acquiring IP assets. Doing so also enables an entity to experiment in different directions before actually expanding into a particular fixed direction. Hence, it is a good option and can open many different doors.

A successful example of this is when Dabur acquired Balsara Group companies, which eventually gave it extended access to seven well-established brands like Promise, Babool and Meswak toothpaste, Odonil air freshener, Odopic utensil cleaner, Sanifresh toilet cleaner, and Odomos insect repellent.

What is IP Due Diligence?

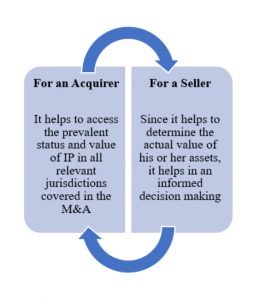

IP due diligence is a thorough investigation, which is conducted to understand the potential and value of the IP portfolio that a target company holds. The evaluation is conducted by considering all forms of IP assets like patents, copyright, industrial designs, trademarks, etc. The same can be offensive or defensive. Defensive due diligence is when the seller conducts the diligence, while offensive due diligence occurs when the initiative is undertaken by the buyer.

The Role of IP Due Diligence and Valuation in M&A

The mere presence of star patents or IP assets does not suffice a successful M&A capable of accruing benefits. Thorough due diligence is mandatory for strategic exploitation. Therefore, the portfolio comprising all IP assets should be read in terms of their strengths and the cost of maintenance, including the remaining time in the total period of exploitative rights reserved in the entity holding such assets. The same constitutes the overall health of the entire portfolio. Reading into the same allows the identification and mitigation of potential risks that may be associated with such a transaction. IP valuation is the most crucial step in IP due diligence. Therefore, to evaluate IP assets, the results of the due diligence are relied upon as they spell out the actual position and standing of the IP portfolio of the target-seller.

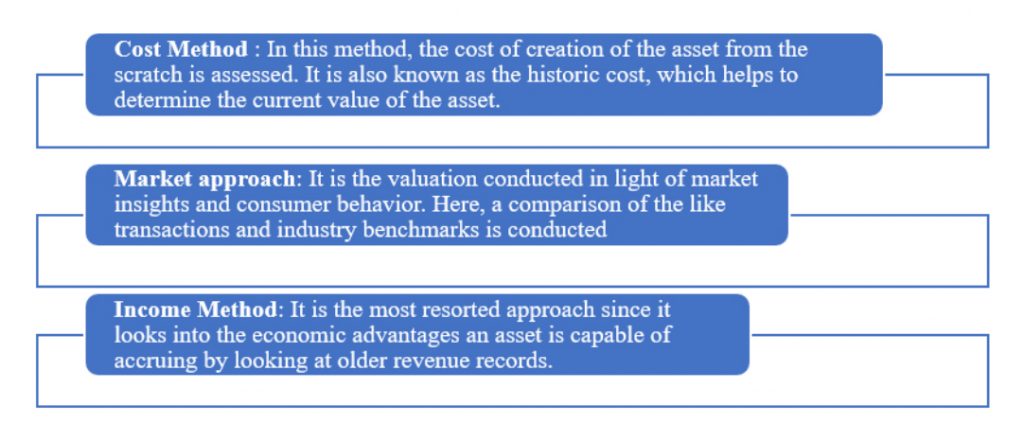

Since due diligence is subject to the needs of a particular company, IP valuation should be conducted in line with the goals to be achieved. A wrong method of discovering the value of the IP could lead to faulty findings. IP valuations must include all Intellectual Property Rights (IPRs) and intangible rights, for example, goodwill, employee know-how, etc. It is vital to consider not only the present value of the IPRs but also their future value. There are three methods of conducting an IP valuation (not exhaustive) as enlisted below:

Importance of Due Diligence from Different Viewpoints

Where due diligence is not conducted or is not comprehensive enough to derive decisive conclusions, it can invite much more than just trouble. A frequently cited example of this is that of Rolls-Royce Motor Cars being acquired by Volkswagen from the conglomerate Vickers PLC for a lump sum amount of US$790 million. The most crucial asset of the transaction, the Rolls Royce brand itself, was left out during negotiation. This brand-name was then, in a separate transaction, acquired by BMW for US$66 million, which was sold by a British jet engine maker, Rolls-Royce PLC. It is amusing how Volkswagen owned the Rolls-Royce automobile business but could not sell the manufactured cars under the Rolls-Royce brand name. This example is a valuable lesson.

Important Steps of Conducting Due Diligence

- Non-Disclosure Agreement (NDA) – The fundamental step before exchanging any priority-class information is the signing of NDAs. These should be mutually signed between both the parties to the transaction, the acquirer as well as the target-seller, to safeguard information culminating from either end. In the absence of such an agreement, enforcing one’s right in court may prove to be arduous, although not impossible, as observed in the Stac vs. Microsoft case. In the said case, Microsoft willingly expressed to collaborate with Stac on its data compression program, and later, it introduced an update in Microsoft MS-DOS 6.0 with its version of Stac’s program in the absence of a license agreement for which Microsoft was taken to court.

- Identification – After signing the NDA, the acquirer can be safely exposed to IP assets, including not just patents but trademarks, copyright, industrial designs, etc. Transparent disclosure of information with respect to each asset can be exchanged to ensure informed decision-making.

- Subject-matter Evaluation – Once the IP assets of the target-seller are identified, an evaluation of their current footing can be made. Such an evaluation should include the following:

- The validity of IP assets should be assessed concerning both registered and pending applications. Companies should read into the assets with expired registrations as well to collect antecedent data and how the assets performed and influenced in maintaining the target seller company. Pending applications are equally vital since they might mature into full-fledged registration accruing the owner’s statutory rights against infringing use.

- Ownership of the IP assets should be determined. There are instances where the target seller has subsidiaries that utilize the assets without concluding a formal agreement as it becomes a customary practice. Such instances should be identified and addressed while negotiating an M&A transaction.

- Jurisdictional Evaluation – All IPRs are territorial and have an expiry date within each particular jurisdiction where the rights are registered. Therefore, it is imperative to evaluate the IPRs in each respective jurisdiction where the acquirer wishes to exploit the said right. The subject-matter evaluation of each of these jurisdiction-specific IPR has to be conducted.

- Third-party Rights – As also mentioned above, it is imperative to determine the existence of any third-party rights in the targeted IP. If the third-party interest is identified, the scope and nature of those rights should be evaluated as they might deter the acquirer from exploiting his rights. These third parties could include a wide range of actors participating through distribution agreements, packaging agreements, licensing agreements, contractual agreements with third parties, and internal employee agreements.

- Litigations – A lot of capital is wasted in costly litigations or dispute settlements. Therefore, an analysis of an existent dispute or a probable dispute can have severe implications on the rights of the acquirer to utilize the IP asset. After establishing that a certain asset is disputed, the acquirer should consider the probability of having a decision in his or her favor from the court, the costs that may be incurred in furtherance of such proceedings, the total time it may take to come to a decisive conclusion.

A much-cited example of these aspects is when Viacom had proceeded against Google for a US$1 billion action following Google’s US$1.6 billion purchase of YouTube, for the reason that YouTube had infringed upon its rights. Google’s acquisition team had not taken into consideration YouTube’s business conflicts with other parties, which ended up costing it heavily.

- Report Formation – Once the data is collected and all aspects are determined, a due diligence report is prepared, which points out the potential risks and liabilities that should be weighed against the listed benefits associated with the IP being dealt with in the transaction. The risk management strategies may also be listed in the report with the many alternatives that can convert viable disadvantages into beneficial stances.

- Warranties and Indemnities – The relevant IP warranties and indemnities must be executed by both parties. IP warranties are the warranties that explicitly state that the target seller is the lawful owner of the IP assets forming part of the transaction, and they do not infringe upon any third-party’s rights. IP Indemnities are taken from the target seller wherein he or she agrees to indemnify the acquirer against any third-party infringement claims concerning the IP rights assigned. The terms of these instruments can be conditional depending on the mutual agreement between the parties.

Once the M&A is concluded between the parties, the acquirer must update the IP assets against his or her name with each IP office located in different jurisdictions. Timely recordal of changes is a must.

Conclusion

It can be concluded that IP assets have greater implications, and therefore, play a vital role in transactions like M&A. As a general principle of caveat emptor, the acquirer should make all decisions following a well-informed backdrop, which is many a time handed over by the seller in the form of a due diligence report. However, it is preferable to conduct one’s due diligence inclusive of IP valuation. Organizations that administer their IP portfolios efficiently will ultimately be the title holders since a majority of M&As, in times to come, will take place only to transact the IP of the target seller, leading to rapid growth on such a basis. ✅ For more visit: https://www.kashishipr.com/

No comments:

Post a Comment